Maximize Your Gift With the Colorado Child Care Contribution Tax Credit

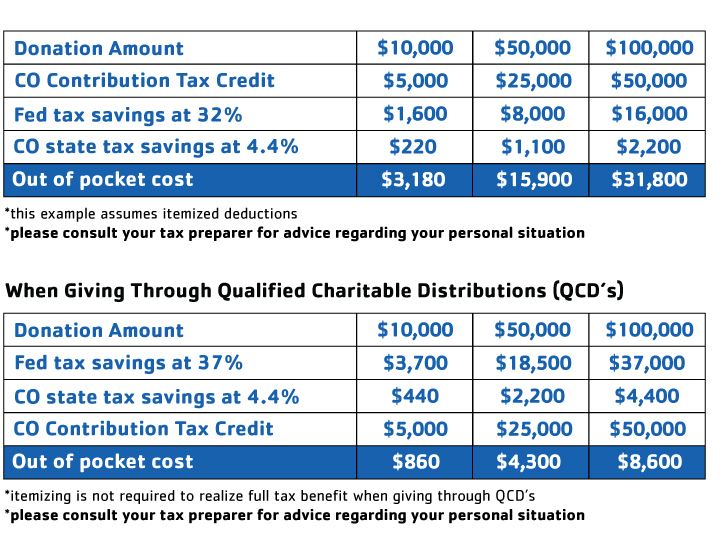

Taxpayers who make a monetary contribution to promote child care in Colorado may claim an income tax credit of 50% of the total donation. You do not need to have children in child care to benefit from this contribution tax credit.

Both corporate and individual donors may benefit. Taxpayers who make a cash contribution to the YMCA of Northern Colorado may claim an income tax credit of 50% of the total donation on their Colorado income tax return. Please check with your accountant; you may need to itemize to take advantage of this tax benefit.